Cons Of Peercoin PPC Mining

LINKS: - - - - - Welcome to! Pure security using only for fair distribution of wealth. Question 1: When people refer to Peercoin's potential as a backbone currency, are they implying it will be used by escrow services where high volume transactions will be off the blockchain and on a separate database instead?

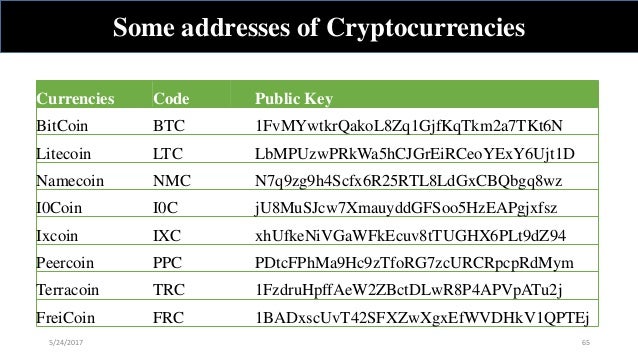

Verification needed. BTC, LTC, Peercoin (PPC) and Namecoin (NMC). No verification requirements for. Selling and mining BTC would not cost an. Cryptocurrency Mining vs. Bitcoin Mining Profitability. Peercoin (PPC) Network Hashrate. 16,838.04 PPC. $0.13 / ($2.99). PPC Peercoin forcing. Bitcoin Forum >Alternate cryptocurrencies >Mining. So A while back I did a hedge investment in Peercoin or PPC I had 1570 cons in a. Peercoin — Rise and Fall. Is it Rising Again? Peercoin is often called the. The mining of Peercoin is smoother. And people gradually started forgetting PPC.

This would make more sense to me since Peercoin has high transaction fees to mitigate its blockchain size. In that case, it seems there won't be very much use for Bitcoin or Litecoin transaction wise unless a person doesn't want the transaction to be recorded by a third party. Peercoin definitely appears more useful for savings. Question 2: If Bitcoin relies heavily on escrow services to move transactions off the blockchain in the future, how will its miners stay in business since they won't be making much money off of scarce transaction fees? Bitcoin can have its transactions on the blockchain but i doubt average PCs will be able to handle the blockchain size or the transaction processing if Bitcoin adoption goes parabolic.

Peercoin is better setup for this contingency since regular users will be collecting 1% interest from minting/maintaining the network while escrow services or supernodes handle off blockchain transactions. Peercoin might become the equivalent of gold reserves. Fundamental Analysis: • Peercoin's PoS model gives it more security because an attacker would need to buy up 51% of all the coins but would make the Peercoin price skyrocket in the process. Also, the attacker would have less incentive to continue the attack because he would have a vested interest in the network with such and expensive stake in it. This type of security seems ingenious to me. • PoS also means it's less capital intensive to maintain the Peercoin network so it doesn't have the 10% tax which Bitcoin pays in energy and hardware expenses for mining/creating PoW.

• Peercoin helps address the issue of economic cycles through its inflation and deflation mechanisms. It destroys transactions to make deflation and to incentivize saving. It credits interest to 30 day active client holders to create inflation and incentivize spending. EDIT: Peercoin appears to be a market in and of itself which is ground breaking in my opinion. Peercoin is a true trail blazer in the innovation of money. If you don't agree with the different philosophy behind Peercoin, you should at least agree it's better for diversification purposes because of how different it is from Bitcoin. Market Analysis: • Peercoin is in the.

• It has a fraction of Litecoin's marketcap. • It has roughly 3 million less coins in current circulation than Litecoin. • Peercoin value has is against Litecoin and Bitcoin.

When Bitcoin rises in value, BTC holders tend to liquidate their positions afterwards and invest into altcoins. Evidently, Peercoin is their top preference. • Expected to be. • Peercoin has first mover advantage in PoS just as Bitcoin has first mover advantage in PoW. Though Bitcoin has first mover advantage overall in cryptocurrency, PoS is more efficient. I see PoS as working smarter and not harder in comparison to PoW.

Peercoin should be thought of as Bitcoin 2.0 if Bitcoin is thought of as Gold 2.0. Bitcoin maybe analogous to MySpace first mover status and cluttered interface while Peercoin might be analogous to Facebook 2nd mover status but cleaner and more efficient interface. As a result, Facebook eventually dominated the market with the largest network effect. Same applies to Google in how it became dominant in search engines.

Critical Analysis: •. Sunny King's, 'If this truly becomes a problem, the default minting algorithm could possibly be revised to include an adversarial strategy to deter such behavior, for example delaying building on top of a 'cheating' block.' • PPC has a flat and high transaction fee of.01 which isn't determined by a market yet. This might not turn out to be a problem. Even if the transaction fee is high, it starts being eaten away by the interest you collect after running your client for 30 days and over. EDIT: Please correct me if i make a miscalculation in all of this math I'm about to do as i'm not good with numbers. I apologize in advance if i make a glaring mistake so reader discretion is advised.

Example, you decide to spend $20 worth of PPC out of your spending wallet(checking account) and you have $5000 in your minting wallet(savings account). The fee is.01 PPC so.01 * $3.1(current price per PPC) =.031 or 3 cents. 1% interest of $5000 PPC for minting in a year is $50. $50 is a lot more than a fee of 3 cents.

$50 /.03 = 8766 or 8766 times you can spend $20 worth of PPC and not worry about the cost of transaction fees. $20 x 8766 = $175,320 worth of total spending which you don't have to worry about the transaction fee cost.IF YOU'RE MINTING. Now IF the Peercoin price goes to $1000 per PPC, the.01 transaction fee will be $10.

BUT that $5000 worth of PPC you had in your minting wallet will be worth $1,612,903!(i'm trying not to circle jerk with guys too much). 1% interest of $1,612,903 = $16129. So the $10 transaction fee won't be a big deal but Peercoin will be more ideal for high value transactions. Also as a side note, each time you transact, $10 worth of PPC will be destroyed.

This will add a tiny amount of deflation or value to your minting wallet balance so you will collect a tiny bit more value from your 1% interest. Obviously the.01 transaction fee incentivizes discipline and the saving of money. That's a really good thing! And when people save money in Peercoin, they service the network! • PPC has checkpoints at the moment.

However, Sunny King he can't arbitrarily control or shutdown the network through checkpoints. • Can't think of anything other critiques to type but I'm open to any critiques someone else has. As i said in, Peercoin looks like it's the most differentiated and undervalued altcoin available. If there was only one altcoin you were allowed to bet on or just diversify with, which would it be? I would choose Peercoin hands down in the long run.

In the short run, i might choose Litecoin because it's attracting more hype and it's expected to soon be implemented on any major exchanges as well. Litecoin has the silver analogy and Peercoin has the Aesop's fable analogy.

Litecoin is the hare and Peercoin is the tortoise while it makes sure and steady gains against Litecoin. Litecoin is the gut feeling play while Peercoin is the smart play if you do your homework. It's the same when you compare the gold and silver as investments. When making investments, you have to be able to see 2 steps ahead of everyone else and i think all of use here understand the future. The recent 1600% gain in PPC reflects the validity of our vision. Am i right in my assessments?

I have to admit Peercoin looks better and better every day i research it. Peercoin seems too good to be true yet I've known about Peercoin for almost 9 months and i haven't given it the attention it deserves until the past few days. If Bitcoin is a radical innovation which strikes at the core of humanity, what do we call Peercoin? I'll disclose that I've accumulated nearly 40% of my crypto portfolio(EDIT: now it's around 70%!) in Peercoin so I'm ever more motivated to learn about Peercoin AND MIGHT BE BIASED!

LOL, I apologize for spamming this sub with so many posts lately but Peercoin's definitely caught my attention. This will be my last post.hopefully:) I would love to read your feedback whether positive or negative(preferable).

Thank you in advance. More from Sunny King: • 'Proof-of-stake is a young approach I am sure quite a bit of improvements can be made. I am generally not as strict regarding hard fork upgrade so we can do quite a bit if needed.' • This means Peercoin is adaptable and able to upgrade and improve.

• 'The proof-of-stake minting provides a service to the ppc network, so why shouldn't those who provide the service receive some compensation? Meanwhile, those who transact in the network with high velocity pay the security cost via low inflation.' • This is talking about the PoS minting and the transaction fee. • 'There are other more cost-effective approach to privacy in my opinion. For example in bitcoin privacy is compromised mainly through the fact that coins belonging to different keys owned by the same user are often combined in the same transaction when spending. This allows blockchain analysis to easily establish what set of keys are from the same user. In bitcoin client combining of inputs from different addressed is automatic, however if this is left to the user to decide then privacy can be much stronger.

I call this approach 'avatar mode', where each key/address is considered an avatar. So the client would not automatically spend coins belonging to different avatars in the same transaction. So you would have a number of avatar addresses to manage. Of course this doesn't guarantee absolute privacy but could be quite an improvement practically speaking.' • This means Peercoin may implement better privacy capabilities in the future. • 'Bitcoin has a long term uncertainty as to whether transaction fees can sustain good enough level of security.

Before that the main concern is how to balance transaction volume and transaction fee levels. Currently I get the feeling that bitcoin developers favor very low transaction fees and very high transaction volume, to be competitive against centralized systems (paypal, visa, mastercard etc) in terms of transaction volume, to the point of sacrificing decentralization. This also brings major uncertainties to bitcoin's future.' • This means Peercoin is designed to remain extremely decentralized, long-term compared to other coins which will have to become more centralized, and in this way it can serve as the decentralized backbone to these other cryptocurrencies, and the entire crypto market in general.

While many are still being turned on to the perks of Bitcoin as a speculative asset, platform, and currency, there are other players in the game. Here is a brief look at how these cryptocurrencies stack up in terms of features. Also, if you’re interested in the rest of the top 10, be sure to check out Bitcoin – First and Biggest (but Maybe Not the Best) Capitalization: 12 Billion Dollars. Price as of 12/2/12: ~$1000 Pros: • Sophisticated, entrenched platform could allow for use beyond currency, and other revolutionary uses due to nearly zero transaction fees. • Biggest market capitalization, greater than 10 billion dollars (). • Secure with some minor caveats including, now may be ), • Massive fanbase for its true decentralization. • Established and accepted.

• Scarce, only 21 million will ever be mined. Cons: • Transactions take a long time to confirm. Three confirmations (usual minimum) takes, but closer to an hour on average in my experience.

Zcash ZEC Mining Chips. • Scarcity and finitude means BTC is inherently. Some feel this is bad, but this really only for people who think BTC could plausibly take over Fiat completely — not plausible in my opinion and therefore irrelevant. • Mining is expensive, costing some $150,000 a day reports. Mining costs may be prohibitive in future growth and transaction verification. On Bitcoin transactions.

• For speculative growth, Bitcoin is perceived as expensive, people don’t like to own one or two of something, but rather 10s or 100s, but this may be solved by a naming convention, calling Bitcoin, mBTC,. In this way, people could buy a thousand milliBitcoins for the price of one Bitcoin. It’s psychological, but it is a real factor in valuation and adoption. Pros: • At.5 billion dollars, it has the second or third biggest market cap, depending on whether or not you consider Ripple to be cryptocurrency (as of (). • Transaction times happen 4x faster than Bitcoin. • Still affordable to a lot of people as an investment whereas Bitcoin is seen as too expensive. Nexus NXS Mining Programs there.

It has a good combination of momentum and affordability right now. • Theoretically, one Litecoin should be worth 1/4 Bitcoin since there will be 4x as many coins. Right now LTC is around $20, and BTC is almost at $1000. It could be argued that Litecoin is therefore undervalued by an order of magnitude (1/50 when it should be 1/4). • More coins than Bitcoin means that Litecoin may be more future-proof than Bitcoin. Cons: • Cannot be purchased directly or other currencies as easily as Bitcoin, ultimately meaning its price is directly connected to Bitcoins.

• Ultimately, Bitcoin has more momentum and support from the community. Litecoin may be the second biggest cryptocurrency, but many feel similar to, “There can only be one. The Network effect is simply too strong. Bitcoin has orders of magnitudes more adoption, acceptance and use compared to any other cryptocurrency on the market.

The game is over and Bitcoin won.”. Peercoin – The Environmentally Friendly Standout Capitalization: 122 Million Dollars. Price as of 12/2/12: ~$6 Pros: • Said to be sustainable and long-term environmentally friendly because mining will require orders of magnitude less power than Bitcoin and Litecoin. • Distinguishes itself from other coins by using “Proof-of-Stake/Proof-of-Work” hybrid. Requires less energy. •.01 Peercoin Transaction fee (on every transaction) is said to render Peercoin a better “store of value,” and it may be used as a backbone cryptocurrency according to, and its creator. • In terms of speculative value, Peercoin has and an excellent logo.

This may increase early adoption. • Peercoin is inflationary, tantamounting to each user’s number of Peercoins growing 1% per year. This means that the number of Peercoins is technically limitless. This may be seen as a con for speculation, but for real-world use is more comparable to modern money systems. Cons: •.01 Peercoin transaction fee means that Peercoin is less liquid and less multifaceted in use than competitors. It would be impractical to use in everyday transactions, a stock market, or anything with high transaction volume.

This will only become more true as its value increases. • Not truly decentralized. Peercoin uses “,” but Sunny King, Peercoin’s creator, says this feature will be removed with future versions and when the cryptocurrency stabilizes. • Peercoin is inflationary which some feel is intrinsically bad. Others have said that “the rich get richer” with peercoin, but the reality is that Peercoin users.

Ripple – Venture Capital’s Electric Money Capitalization: 5 Billion Dollars. Price as of 12/2/12: ~$.05 Pros: • Company behind it, OpenCoin received some.

Additional round of funding for Opencoin’s evolution into Ripple Labs. • Non-decentralization means simpler legal integration and likely government adoption, but has invoked the wrath of decentralization fans who call it ” • is said to allow conversion between any currencies. • Ripple platform allows for issuing debt via “IOUs,” Bitcoin can also do this as a platform, but this feature has yet to be explored.

• Mining Ripple now means donating computing time. Cons: • 100 billion total Ripples (XRP) with all of them “pre-mined,” as Ripple is not a cryptocurrency. • Ripple Labs possesses some 50 billion Ripples in hopes they will increase in value. • Muddled marketing strategy.

Ripple Labs stated they would give away Ripple and even so to to build awareness. This has led to many thinking their Ripples may be worthless and will hurt price increase. That Ripple Labs will no longer be used this strategy. • Largely perceived by crypocommunity. Adoption and use will have to be from other, mainstream avenues. Namecoin – Cryptocurrency, Buy Now, Get One Free Internet Capitalization: ~60 Million Dollars.

Price as of 12/2/12: ~$8 Pros: • 21 Million total means that Namecoin will be relatively scarce, exactly the same as Bitcoin’s scarcity level. • Permits for, disallowing governmental control. • Versatile platform can be used to recreate decentralized, unregulated Domain Name System, sort of like its own internet. Can also be used for messaging, voting, and login system –. • Uses identical cryptography to Bitcoin protocol meaning Bitcoin miners could mine Namecoin profitably should Bitcoin mining become unprofitable. Cons: • Permitting for an uncensored internet means Namecoin could lead to illegal activities online, beyond even the scope Bitcoin, such as child abuse or similarly illegal websites.

• While an alternate DNS system is useful, Namecoin as a cryptocurrency distinguishes itself in no other way from Bitcoin. • Namecoin that underminds domain name registration service. Vulnerability will be repaired in a future block, however. Questions/Comments/Corrections please email danny at heavy dot com.