Dash DASH Mining Calcualtor

What is this? The diff change is the rate at which the network difficulty is changing every month. Diff change is used for the estimated future profits graph and break-even analysis. Typically in crypto, network difficulty tends to increase over time, meaning a miner will generate less crypto with the same hardware. Accounting for this changing difficulty is essential to generate long term profitability predictions. How is this value calculated? The diff change value is calculated by looking at the current difficulty and comparing it to the 12 hour moving average of the difficulty one month ago.

An easy to use crypto-currency finance utility used to calculate a Dash miner's potential profits in DASH and multiple fiat currencies. The calculator fetches price. DASH Calculator (Beta) This calculator calculates potential payouts of 2-year Genesis-Mining DASH contracts. Enter the following variables: Hash Rate – This is the. Dash Mining Profitability Calculator. If you are unsure how profitable mining Dash crypto currency can be, this calculator is for you. It will give you estimated profit margins based on the current dash difficulty and DASH to USD price. Simply fill out your hashing power (also known as hate rate), any pool fees you many have to. The foundation of Dash is its blockchain, which is a decentralized ledger of all transactions that have ever taken place. This blockchain is secured through a.

For smaller coins the diff change can sometimes be inaccurate due to a wildly fluctuating difficulty. Can I disable it? The diff change factor can be disabled by either manually setting it to 0 or clicking a 'Use Diff Change' switch found below the graph and in the break-even analysis section. What is this?

The Break-Even Analysis feature can help you predict how long it will take to become profitable for a given setup. How is this calculated? Time to break-even is calculated by comparing your hardware cost (which you must enter below) to your predicted monthly profits and seeing how long until the initial hardware cost is paid off. The calculator also takes the changing difficulty (diff change) into account. If the network difficulty is increasing quickly, this will greatly increase your break-even time. The diff change can be excluded from the calculation by toggling the 'Use Diff Change' switch.

Why is my break-even time 0 or never? If your break-even time is 0 you have likely forgotten to input your hardware cost below. If it is never, your break-even time has been calculated to be greater than 10 years. This is likely due to a large diff change value which causes your predicted profitability to turn negative in the future. You could try lowering the diff change for a less agressive prediction or disable it altogether.

What is this? The profitability chart can help you visualize your long term mining projections. The chart can operate in one of three views: Total Profits The Total Profits view predicts what your overall profitability will be in the future. This is calculated by taking your current profits and adding them to each following months profits while factoring in the changing difficulty (diff change), the diff change factor can be disabled. This view assumes the price of the coin will stay the same.

If you wish to account for a changing price (ie if you think the price will rise in the future), switch to the 'Coins Generated' view. Coins Generated This view looks at the number of coins you can expect to generate in the future. This view does not account for any expenses, it simply predicts how many coins you will generate with your given hashrate and the diff change value. A high diff change will cause you to generate fewer coins in the future.

Total Costs This view sums your power and recurring costs. It can be used to predict the total cost to operate your mine over a given period of time. What is this? Price Change allows you to factor in the changing price of the currency into your projections. You can use this to generate accurate best-case and worst-case projections for your operation. Why does Price Change default to 0?

It is impossible to predict what the price of any coin will be in the future, we leave the price predictions up to you. How does this value factor into the calculations? It depends on what Selling Profile is set to.

For more details, click on the question mark beside the Selling Profile field found directly below Price Change. What is this? Selling Profile tells the calculator how to use the Price Change value. Price Change must be set to something other than 0 to have any effect on the profitability projections. Selling Profile has 4 different options: Sell Coins Monthly Profitability is calculated as if you were to sell all of your mined coins at the end of each month.

Your profits will equal (money earned from selling) - (total expenses + hardware costs) Sell to Cover Expenses Only sell enough crypto to cover your monthly expenses. (electricity, rent, etc.) Your profits will equal (unsold crypto * predicted price) - (hardware costs) Sell a Portion Monthly Selecting this option will show the Sell Monthly field below, this is where you input what portion of crypto you would like to sell each month. For example, if you plan to sell 25% of your new crypto, enter 25 into the Sell Monthly field. Your profits will equal (money earned from selling) + (unsold crypto * predicted price) - (total expenses + hardware costs) Never Sell Coins Select this option if you plan on holding all of your crypto.

Gulden NLG Mining Laptop here. Your profits will equal (all crypto mined * predicted price) - (total expenses + hardware costs).

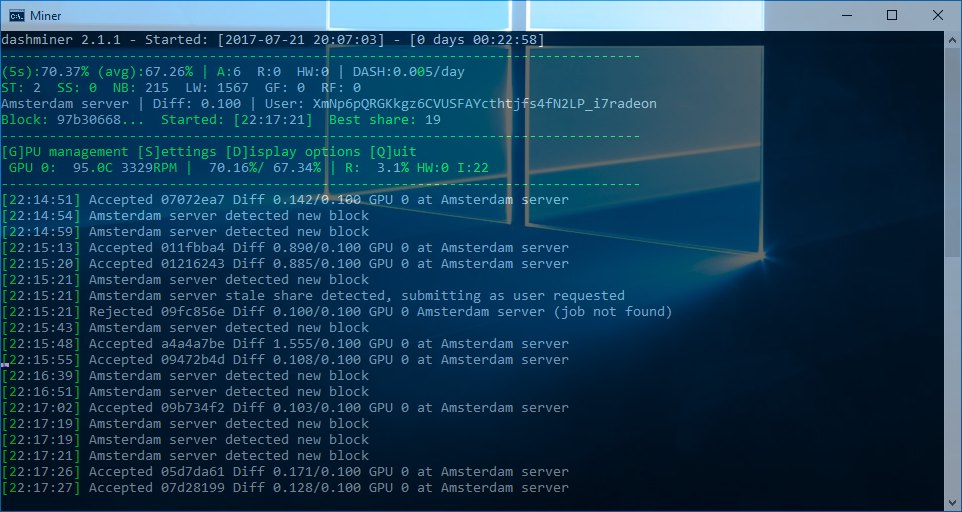

Last updated June 27, 2017 One of Dash’s main claims to fame is the meteoric rise to $120+ USD prices. Now might be a good time to grab a piece of the pie. Gain high rewards in a network that has yet to be saturated to the point of the Bitcoin Blockchain. Best Dash Mining Hardware Dash indeed has ASICs that have been made for mining. These have been designed specifically to work most optimally for the X11 mining algorithm. Here are some examples: The Antminer D3 is probably the best miner on the market right now: You can also find non-ASIC mining hardware with some of the highest hash rates for X11 mining below: • • • • Dash Mining Pools You’ll find that you can receive more consistent rewards by joining a Dash mining pool than by working on your own.

The official website recommends the following pool mining providers (note that some of the links on that page are broken). We have selected some active pools for you here: It’s important to stay on top of mining pool updates if you decide to go down this route to ensure that you don’t get stuck with a pool that suddenly bumps up its fees. You also don’t want to be mining for a pool that’s no longer running. Make sure to do the required research to ensure that you receive the rewards that your hashing power deserves. Dash Mining Algorithm Dash employs the X11 mining algorithm, which comes with a series of positive and negative consequences. Upsides Encourages Decentralization The X11 mining algorithm encourages decentralization by discouraging the use of ASIC hardware. At least for the time being, X11 is quite complicated to implement with custom circuits.

This means that miners have good reasons to use affordable mining hardware that an average Joe like you and I can set up easily as well. By keeping affordable hardware relevant in the X11 mining game, we find that centralized operations with massive ASIC racks aren’t justifiable for casual Dash mining. However, keep in mind that this will change in the foreseeable future. Affordability X11 mines with relatively low power consumption compared to Bitcoin’s SHA256 PoW (Proof of Work) algorithm. This means that casual users are more likely to find their power cheap enough for a personal mining project. Efficiency X11 boasts to be efficient to the point of reducing the strain on your hardware.

As a result, you’ll find that your cards will run cooler than if they worked on Bitcoin’s SHA256 algorithm, which makes your cards last longer and less prone to abrupt overheating. Downsides Lacking Community Although X11 itself is quite widespread, the mining saturation of each individual coin is low compared to the Bitcoin network itself. This means that even though you might find more rewards than when mining, say, Ethereum or Bitcoin, the reward will not be worth as much. Introduction of ASIC While X11 was designed with the intention to stave off ASIC miners, we’re already seeing ASIC miners flooding the Dash mining scene.

In a sense, this removes one of the main selling points that X11 had at the time of its release. Dash Mining Profitability Before jumping into any major purchases, make sure to estimate whether your circumstances can lead to dash mining profits. Use this Dash to predict projected profits based on your power consumption, hashing power and electricity costs. It can help to compare different profitability estimators to have higher confidence as to what you might be spending on running your rig. Here are some suggestions: You can also find plenty of profitability calculators, like, that let you calculate the profitability of several other altcoins on the market.

Mining Other X11 Coins X11 is also used by several other cryptocurrencies. These are: Darkcoin, GiveCoin, Global Denomination, Hirocoin, Logicoin, StartCoin, SmartCoin, Europecoin, LimeXCoin, Muniti, Quebecoin, XCurrency and some less serious cryptos like ConspiracyCoin, Cannabiscoin, HashCoin and Nyancoin. As you can imagine, all hardware that proves to be effective for Dash mining should also be productive for other X11 based coins.

Just keep in mind that your ROI will likely be much higher by mining Dash because of its vastly higher price than its competitors. However, it’s worth noting that one of the other coins might overtake Dash in the future. It might seem unlikely now, but you never know.